OMV

| |

| Joint stock company | |

| Traded as | WBAG: OMV |

| Industry | Oil and gas |

| Founded | 1956 |

| Headquarters | Vienna, Austria |

Key people | CEO Rainer Seele |

| Products | Oil and gas exploration and production, natural gas trading and transportation, oil refining, electricity generation |

| Services | Fuel stations |

| Revenue |

|

Number of employees | 24,124 (2015) |

| Website |

www |

OMV (formerly "Österreichische Mineralölverwaltung", ÖMV), is an international, integrated oil and gas company, headquartered in Vienna. It is active in the upstream (Exploration and Production) and downstream businesses (Refining and Marketing as well as Gas and Power). With group sales of EUR 23 bn, a global workforce of 24,124 and a market capitalisation of EUR 9 bn (end of 2015), OMV is one of the largest listed industrial companies in Austria.[1]

History

The history of OMV began on July 3, 1956, when the company then known as “Österreichische Mineralölverwaltungs Aktiengesellschaft” was officially entered into the commercial register.[2] Consequently, the Soviet Mineral Oil Administration (Sowjetische Mineralölverwaltung, SMV), a corporation formed during the Soviet zone of occupation in post-war Austria became “Österreichische Mineralölverwaltungs Aktiengesellschaft”.

Four years later, in 1960, the company opened the Schwechat refinery near Vienna, in 1968 the first natural gas supply contract with the former USSR were entered.[3] At the end of 1987, 15% of OMV was privatised, making it the first public listing of a state-owned company in Austria. In 1989, OMV acquired a 25% stake in plastics group, Borealis.

In 1990 the company opened its first filling station in Vienna-Auhof on 26 June 1990.

The International Petroleum Investment Company (IPIC) of Abu Dhabi acquired an initial 19.6% interest in the group at the end of 1994. The following year, the group changed its name from "ÖMV" to "OMV" because the umlaut on the "Ö" is not commonly used in many languages.

In the early 2000s, OMV expanded into Eastern Europe, by acquiring around 10% of Hungarian oil company, MOL and in 2003 it acquired the upstream division of Germany’s Preussag Energie, expanding its filling station networks.

In 2004, OMV became the market leader in Central and Eastern Europe following the acquisition of 51% of Romanian oil and gas group Petrom which constitutes the largest acquisition in OMV’s history.

In the same year, OMV increased its share capital, meaning that more than 50% of the company’s shares were in free float for the first time. Following the sale of 50% of the subsidiary company Agrolinz Melamine International GmbH to IPIC in 2005, the Borealis group was taken over in full together with IPIC.

In 2006, OMV acquired a 34% stake in Turkish oil group Petrol Ofisi. In the same year, the board members of OMV and Verbund, the Austrian utility group announced plans for a merger. However, this collapsed due to resistance from Austrian MPs.

OMV increased its stake in Hungarian oil group MOL to 20.2% in 2007. OMV then sold its entire stake in March 2009 after MOL rejected a takeover bid in 2008 and the European Commission imposed tough restrictions for an approval of the deal. OMV acquired the stake held by Dogan Holding in Petrol Ofisi in late 2010, which further increased its stake in the company to 95.75%.

In 2012, the Domino-1 well in the Romanian Black Sea exploration licence Neptun was the most significant discovery in that year, which has the potential to be OMV´s most important gas discovery ever.

On October 31, 2013 the acquisition deal with Norwegian Statoil containing participations in oil and gas fields and in development projects in Norway and the UK was closed. Proven and probable reserves will climb by about 320 mn boe. With 2.65 bn USD, this is the largest transaction in OMV’s history.[4][5]

A divestment agreement for the 45% stake in Bayernoil was signed in December 2013. The sale was closed in June 2014.[6]

Finance information

Key figures 2015

With Group sales of EUR 23 bn, a workforce of 24,124 employees and a market capitalisation of EUR 7 bn by the end of 2015, OMV Aktiengesellschaft is one of Austria’s largest listed industrial companies.[1]

Shareholder structure 2015

- ÖBIB, formerly ÖIAG (31.5%)

- IPIC (24.9%)

- Own Shares (0.3%)

- Free float (43.3%)[1]

Shareholdings

The most important shareholdings of OMV Aktiengesellschaft are listed below, with other shareholdings held by the appropriate business segments:[7]

- Borealis AG (36%)

- Gas Connect Austria (100%)

- OMV Petrol Ofisi (99%)

- OMV Petrom SA (51%)

Business segments

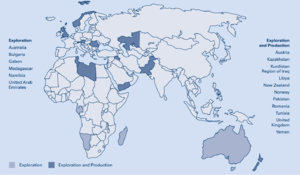

Upstream

In Upstream, OMV focuses on three core regions, (1) CEE (Romania and Austria), (2) the North Sea and (3) Middle East and Africa, and selected development areas. OMV had proven reserves of approximately 103 million barrels (16.4×106 m3) at year-end and a production of 303,000 barrels per day (48,200 m3/d) in 2015. Around 90% of its production in 2016 came from EU/OECD countries. The oil/gas split in production is roughly 50/50.[1]

Downstream

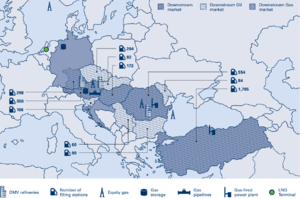

The Downstream Business Segment consists of the Downstream Oil and the Downstream Gas business.

Downstream Oil operates three refineries: Schwechat (Austria) and Burghausen (Germany), both of which feature with integrated petrochemical production, as well as the Petrobrazi refinery (Romania) which processes predominantly Romanian crude. OMV thus has an annual refining capacity of 17.8 mn t by the end of 2015. The retail network consists of approximately 3,800 filling stations in 11 countries with a strong brand portfolio. Together with a high-quality non-oil retail business (VIVA) and an efficient commercial business, OMV has a leading position in its markets.[1]

OMV's Downstream Gas supply portfolio consists of equity gas and is complemented by contracted volumes. Total natural gas sales volumes amounted to 110 TWh in 2015. OMV operates a gas pipeline network in Austria and owns gas storage facilities with a capacity of 2.7 bcm (30 TWh). The Central European Gas Hub (CEGH) is established as an important gas trading platform on the gas routes from East to West and also operates a gas exchange. The gas distribution node in Baumgarten is Central Europe’s largest entry point for gas from Russia. OMV also operates two gas-fired power plants, one in Romania and one Turkey.[1]

Controversies

Petrom

The acquisition of 51% stake in Petrom was considered controversial as the privatisation contract was not been made public and it consists of several disputed clauses.

The privatisation allegedly produced a market monopoly. Critics say that OMV can use the resources Petrom owns until their exhaustion. Also fixing of tax for gas and oil exploration at 3 to 13.5 percent from the final delivery price for 10 years was criticised. Some critics claimed, that the price €1.5 billion was too low.

MOL

In June 2007 OMV made an unsolicited bid to take over MOL, which was rejected by the Hungarian company. MOL criticised OMV's advertisement in which OMV had suggested the two had already worked together on the European market. MOL thought that to be misleading and unethical and asked OMV to remove the name MOL from those advertisements. OMV dismissed its bid after negative results of the investigation by the European competition authorities.[8][9] OMV sold its entire stake to Surgutneftegas in March 2009.[10]

See also

References

- 1 2 3 4 5 6 OMV Annual Report 2015

- ↑ 60 years and still going strong: OMV’s moving history Retrieved on July 4, 2016.

- ↑ "OMV History". OMV. Retrieved 31 March 2014.

- ↑ OMV Press Release. OMV agreed on a major asset acquisition in Norway and the United Kingdom (UK) with Statoil. Retrieved on March 27, 2014.

- ↑ OMV Press Release. OMV closes acquisition deal with Statoil. Retrieved on March 27, 2014.

- ↑ OMV Press Release. OMV closes the sale of Bayernoil. Retrieved on April 13, 2015.

- ↑ OMV Group Presentation. Retrieved on July 6, 2015.

- ↑ "European Commission closes door on OMV-MOL merger plan". Realdeal.hu. 7 August 2008. Retrieved 7 December 2008.

- ↑ "OMV gets EU objections statement over MOL takeover bid". Forbes. 24 June 2008. Archived from the original on 24 May 2011. Retrieved 6 December 2008.

- ↑ "OMV sells MOL stake". OilVoice. 30 March 2009. Retrieved 30 March 2009.

External links

- Official website

- ÖBIB

- OMV Petrom

- OMV Petrol Ofisi

- Borealis

- Gas Connect Austria

- Central European Gas Hub