CRH plc

| |

| Public limited company | |

| Traded as | ISEQ: CRG, LSE: CRH, NYSE: CRH |

| Industry | Building materials |

| Founded | Irish Cement Limited (1936), Roadstone Limited (1949) & merger (1970) |

| Headquarters | Dublin, Ireland |

Key people |

Nicky Hartery, (Chairman) Albert Manifold, (CEO) |

| Products | Cement, aggregates, readymixed concrete, asphalt/bitumen and agricultural and/or chemical lime |

| Revenue | €23,635 million (2015)[1] |

| €1,378 million (2015)[1] | |

| €729 million (2015)[1] | |

Number of employees | 76,000 (2015)[2] |

| Website | www.crh.ie |

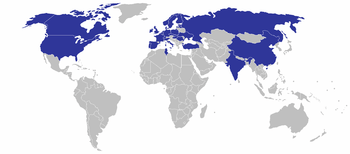

CRH plc is the parent company for an international group of diversified building materials businesses which are engaged in the manufacture and supply of a wide range of building materials and in the operation of builders’ merchanting and DIY stores. The company is incorporated and domiciled in Ireland where it ranks as the largest Irish company.[3]

CRH has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index. It has secondary listings on the Irish Stock Exchange (where it is a constituent of the ISEQ 20) and New York Stock Exchange.

History

The company, whose name is an abbreviation of Cement Roadstone Holdings, was formed through the merger in 1970 of Cement Ltd (established in 1936) and Roadstone Ltd (established in 1949).[4]

The company went public on the Irish Stock Exchange in 1973.[5]

Europe

CRH's first international purchase was Van Neerbos, a concrete products producer and distributor in the Netherlands. Other acquisitions in Europe followed throughout the 1970s and 1980s including businesses in the United Kingdom, Spain, the Netherlands and Germany,

- In the 1990s the company moved into France with a number of buys including Raboni SA, a builders merchant company and drainage systems and concrete vault manufacturing group Prefaest SA.[6]

- In 1999 CRH bought Finnsementti Oy, Finland's only cement producer, and Lohja Rudus Oy, Finland's country's top producer of aggregates and ready-mix concrete.[7]

- The company entered Switzerland in 2000 with the EUR 425 million purchase of Jura Group, adding cement, concrete and aggregates operations, as well as a regional distribution network.[8]

- In the following year, CRH took an interest in Nesher Israel Cement Works, the only cement producer in that country, by taking a 25% stake in its holding company Mashav.[9]

- In July 2003 it agreed to pay EUR 693 million to acquire Cementbouw - a market-leading do-it-yourself store chain and building materials producer in the Netherlands [10]

- In 2004 CRH paid €429m to purchase a 49 percent stake in Portuguese cement producer Secil. It sold that stake again in 2012 for €574m following a ruling on a shareholder dispute by an arbitration tribunal at the Paris-based International Chamber of Commerce [11]

- In February 2015, CRH agreed to purchase the UK building materials producer Lafarge Tarmac.[12]

US

CRH entered the United States in 1978 by buying Amcor, a concrete products group in Utah which would then form the basis of the company's U.S. division, which is now called Oldcastle Inc.. Subsequent large purchases in the US include

- Callanan Industries, a New York State based aggregates and asphalt producer in 1985 [13]

- Betco Block & Products Inc, of Bethesda, Maryland in 1990 [14]

- Balf Co. in Connecticut, Lebanon Rock in Pennsylvania, Keating in Massachusetts and Sullivan Lafarge in New York state in 1994 [15]

- Allied Building Products, which specialized in roofing and cladding products and Tilcon, a major road construction specialist in the Northeast in 1996 [16]

- Ohio's Shelly Group in 2000,[17]

- Mount Hope Rock Products, based in New Jersey in 2002[18] and

- Ashland Paving And Construction (APAC) of Atlanta in 2006. APAC was the company's largest ever deal.[19]

- In 2007 it purchased four companies, worth a total of $350 million (€251 million) to add to its US materials division: these companies are Conrad Yelvington Distributors Inc. (CYDI), Eugene Sand & Gravel, Cessford Construction and McMinn's Asphalt and Prospect Agrregates.[20]

- Also in 2008 CRH agreed to purchase landscape paver, Pavestone, for $540 million.[21]

Central and Eastern Europe

In 1995, CRH made its first entry into new or emerging markets when it bought Holding Cement Polski, which later gained majority control of Cementownia Ozarow, one of the Poland's major cement producers.[22] That acquisition also marked the first CRH cement manufacturing operation outside Ireland. By the end of the decade, CRH numbered more than a dozen operations in Poland and it has since invested in cement production in neighbouring Ukraine,[23] most recently with the announcement of an agreement to buy Mykolaiv Cement from rival Lafarge.[24]

Emerging markets

In 2006 CRH took a new turn and invested in a cement factory based in the Heilongjiang region in China.[25] It has built on that presence acquiring a 26% stake in the Jilin Yatai Group and an option to acquire 49% in the future.[26]

In 2008 CRH agreed to buy a 50 percent stake in Indian cement company My Home Industries Ltd. for €290 million ($452 million).[27] CRH has confirmed that it is interesting in looking at other opportunities in India [28]

Governance and operating structure

Headquarters and board

CRH is registered in Ireland and headquartered in Dublin city. It has a board of 12 members[29]

Three Directors are executives of the Group

- Albert Manifold, Chief Executive (Ireland)

- Maeve Carton, Finance Director (Ireland)

- Mark Towe, Chief Executive Officer, Oldcastle, Inc.(US)

Each of the nine remaining sits as a Non-Executive Director

- Nicky Hartery, Chairman (Ireland)

- Ernst Bärtschi (Switzerland)

- Bill Egan (US)

- Utz-Hellmuth Felcht (Germany)

- John Kennedy (UK)

- Jan Maarten de Jong (Netherlands)

- Donald A. McGovern, Jr. (US)

- Heather Ann McSharry (Ireland).

- Dan O’Connor (Ireland)

Mr O'Connor is the Senior Independent Non-Executive Director[30]

Structure

The CRH business today is structured into four activities:[31]

- Heavyside materials

- Heavyside products

- Lightside products

- Distribution

Financial performance

The following is a summary of financial data:[32]

| €m | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 23,635 | 18,912 | 18,031 | 18,659 | 18,081 | 17,173 | 17,373 | 20,887 | 20,992 | 18,737 | 14,449 | 12,755 |

| EBITDA | 2,219 | 1,641 | 1,475 | 1,640 | 1,656 | 1,615 | 1,803 | 2,665 | 2,860 | 2,456 | 1,957 | 1,740 |

| Depreciation | 887 | 680 | 725 | 748 | 742 | 786 | 794 | 781 | 739 | 664 | 556 | 516 |

| Amortisation | 55 | 44 | 650 | 47 | 43 | 131 | 54 | 43 | 35 | 25 | 9 | 4 |

| EBIT | 1,277 | 917 | 100 | 845 | 871 | 698 | 955 | 1,841 | 2,086 | 1,767 | 1,392 | 1,220 |

| Profit on Disposals | 101 | 77 | 26 | 230 | 55 | 55 | 26 | 69 | 57 | 40 | 20 | 11 |

| Profit before Finance costs | 1,378 | 994 | 126 | 1,075 | 926 | 753 | 981 | 1,910 | 2,143 | 1,807 | 1,412 | 1,231 |

| Finance costs (net) | (389) | (288) | (297) | (289) | (257) | (247) | (297) | (343) | (303) | (252) | (159) | (146) |

| Associates | 44 | 55 | (44) | (112) | 42 | 28 | 48 | 61 | 64 | 47 | 26 | 19 |

| Profit Before Tax | 1,033 | 761 | (215) | 674 | 711 | 534 | 732 | 1,628 | 1,904 | 1,602 | 1,279 | 1,104 |

| Income Tax | (304) | (177) | (80) | (120) | (114) | (95) | (134) | (366) | (466) | (378) | (273) | (232) |

| Profit after tax | 729 | 584 | (295) | 554 | 597 | 439 | 598 | 1,262 | 1,438 | 1,224 | 1,006 | 872 |

Controversy

Cartel accusations

Europe

In Poland in 2007, CRH was fined €530,000 by the Polish Competition and Consumer Protection Commission for interfering with evidence that Polish authorities were gathering for a price-fixing investigation.[33]

In 2009, Grupa Ożarów (in which CRH first invested in 1995) was fined €26 million for operating a price fixing cartel in Poland.[34] The Polish Competition Regulator stated that seven companies, which accounted for almost 100 per cent of the market, had fixed minimum prices for grey cement, and agreed on a market share for each operator. CRH has stated its belief that Ozarów operated an independent commercial policy in Poland and the fine has been appealed.[35]

In Ireland in 1994, Irish Cement Limited, a wholly owned subsidiary of CRH, was determined by the European Commission to be part of price fixing and market sharing cartel across Europe which it said had illegally and artificially inflated the price of cement throughout the continent. A fine of over €3.5 million was levied.[36]

In Ireland also in 1996, High Court proceedings were initiated against CRH, its subsidiaries and two competitors in which the plaintiffs accused CRH and the others of operating a cartel and employing an illegal and anti-competitive eviction strategy in order to put them out of business.[37] In 2012, CRH applied successfully to have the claim dismissed on the basis of the "inordinate and inexcusable delay" in bringing forward any evidence in the case.[38] That judgement was appealed to the Supreme Court. At the time of the appeal it emerged that the presiding judge in the proceedings had ownership of some shares in CRH and was forced to stand down.[39]

In 2011, a separate High Court action was initiated against CRH by another company who claimed CRH operated a cartel and abused a position of dominance in order to evict it from the market. The case is on-going.[40]

The cement and concrete industry is currently under investigation by the Irish Competition Authority.[41]

United States

In 2006, an antitrust lawsuit was filed in California against Oldcastle Precast (CRH subsidiary) and three AT&T affiliates. The defendants were alleged to have unreasonably restrained trade and conspired to monopolize telephone vaults for land-line connections. Plaintiffs challenged a contract requiring developers to purchase Oldcastle Precast product for properties served by AT&T infrastructure. They also contended the arrangement led to Oldcastle Precast capturing northern California sales of precast electrical vaults, which were often placed concurrently with telephone structures. In 2010, an American Court of Appeal ruled that the Plaintiff’s counsel had failed to provide enough evidence to show that the defendants Oldcastle Precast Inc. and three AT&T affiliates harmed competition in California and Nevada telephone vault markets.[42]

In October 2009, a cement and concrete price fixing class action lawsuit was filed in Florida against Oldcastle Materials (CRH subsidiary) and others. The claim alleged that the defendants eliminated competition in the market for cement and concrete by charging artificially high prices from at least the period 2000 to 2009. The claim further alleged that the conspiracy was facilitated through in-personal meetings, telephone conversations and other communications. In 2008 the defendants announced uniform price increases for concrete and cement, bringing their prices to the same level at the same time, the lawsuit claimed. Then in September a number of defendant companies cut the price of concrete in an effort to lure customers away from independently owned concrete firms. The lawsuit stated that the practices alleged in the cement and concrete industry were clearly illegal.[43]

In 2012, the case was settled for undisclosed terms.[44]

Allegations of corrupt payments to politicians

Poland

In 2005, a Polish businessman, Marek Dochnal, alleged to a Polish Parliamentary Inquiry that he had arranged a bribe of almost $1 million for CRH to a former minister for privatisation, Wieslaw Kaczmarek, in connection with the privatisation of a cement plant at Ozarow, in central Poland, in 1995.[45] CRH which now owns and operates the cement plant at Ozarow said the allegations were "without foundation".[46]

It was also revealed in 2005, that CRH contributed €125,000 to a charity founded by the wife of Poland’s President, Jolanta Kwasniewska. Both CRH and the Polish first lady denied any sinister motive behind the transaction.[47]

Ireland

In 2003, CRH was accused of making corrupt payments to Ireland’s former Taoiseach (Prime Minister) Charles J. Haughey as details emerged of how Mr. Haughey received crooked payments from various companies and businessmen in return for political favours. In 1969, Roadstone Ltd (CRH) sold 80 acres of land to Mr. Haughey, the then Minister of Finance, for £120,000. In 1973, Mr. Haughey sold 17.5 acres of that land back to CRH for £140,000. Within four years, Mr. Haughey had made a net profit of £20,000 and 62.5 acres at CRH’s expense.[48] Charles J. Haughey was also offered chairmanship of CRH in 1972.[49]

Illegal Ansbacher Bank

The existence of a clandestine bank illegally providing off shore accounts first emerged in 1997 during the McCracken Tribunal set up to investigate reports of secret payments to corrupt former Taoiseach (Irish Prime Minister) Charles Haughey and former cabinet minister Michael Lowry.[50]

It emerged this illegal bank was founded in the 1970s and was being run by Des Traynor who was chairman of CRH from 1989 to 1994 and who ran his bank during that period out of CRH’s registered office in Dublin's Fitzwilliam Square where the company provided an office for its chairman. Mr. Traynor was also personal financier to Charles Haughey.[51]

During the investigation it materialised that Justice Moriarty held approximately £500,000 in CRH shares and while that in his opinion precluded him from investigating certain matters concerning CRH he was not, he said, precluded from inquiring into banking activities conducted from Des Traynor's offices at Fitzwilliam Square[52] Sharp criticism was laid upon those in charge of appointing Moriarty given his shareholding[53]

In 1999, as evidence on the scale of the Ansbacher accounts grew Taniste (Irish Deputy Prime Minister) and PD Minister Mary Harney asked the High Court to appoint inspectors who could identify the account holders.[54]

The High Court Inspectors' report was published in 2002[55] It found that eight out of fifteen CRH directors held Ansbacher accounts, including four former Chairmen.[56] It also concluded (Chapter 15, p. 189) that "CRH as a corporation cannot be said to have knowingly assisted in the carrying out of Ansbacher’s activities in Ireland"[55]

After the publication of the report CRH acknowledged publicly that its then Chairman had "misused its facilities and personnel" which "represented a grave breach of trust by Mr. Traynor"[57]

Sale of Glen Ding Lands

In 1998, further questions were asked about CRH’s influence and political corruption when Dáil Éireann (Ireland’s Parliament) voted against an investigation into why an asset with the potential to produce a yield of £48 million in terms of sand and gravel reserves was sold to Roadstone, a subsidiary company of CRH, without public tender for £1.25 million in 1991.[58]

Many opposition members of parliament voiced concerns that at the time of sale, Charles J. Haughey was Taoiseach and his financier Des Traynor was Chairman of CRH. Dáil Éireann however voted not to investigate whether CRH had donated funds to any political party or politician before or after the purchase of Glen Ding. Subsequently, corrupt findings in unrelated matters have been made against a number of those who voted against the investigation.[59]

The State's Comptroller and Auditor General conducted an investigation into the sale and found that the competing bid fell "far short of" the Roadstone offer and that "The Department acted at all times in the best commercial interests of the State" (Section 9.6). It did also note "even though it is unlikely that the Roadstone offer would have been bettered. The attraction of concluding the sale at what was considered a good price outweighed the imperative to act evenhandedly which is a basic principle when the State is doing business" It was noted by the Department's Accounting Officer that the Roadstone offer "was more than 50% above the only alternative offer received", that another bidder "was afforded every opportunity" to make a better offer and that given subsequent delays and planning issues "In retrospect the deal had proved to be exceptional".[60]

The Glen Ding transaction was further investigated by the Moriarty Tribunal which in 2006 reported its conclusion "that there was no connection, directly or indirectly, between Mr. Charles Haughey and any aspect of this disposal, nor any connection between the operation of the Ansbacher accounts and any aspect of the disposal."[61]

Public criticism

In 2005, opposition TD (Teachta Dála - Irish member of parliament) Phil Hogan, who later became Minister for Environment (2011 - ), stated in Dáil Éireann that "there is a widespread problem with competition in this economy………In the case of CRH, profits have been extracted from the Irish economy by means of a complex industry structure that is both anti-competitive and anti-consumer. The European Court of First Instance and finally the European Court of Justice have upheld findings of serious anti-competitive behaviour against CRH and other. While Sweden, Finland, UK, France and Germany have since levied huge fines against the cement industry, Ireland’s answer has been a stony silence."[62]

In 2011 TD Shane Ross, a repeated critic of CRH as a journalist stated that "CRH disturbs" him and questioned why there had been no investigation of CRH in Ireland considering the adverse findings made against the company elsewhere.[63]

See also

The major international materials groups that would be comparable to CRH include

- Cemex Mexico

- HeidelbergCement Germany

- Holcim Switzerland

- Italcementi Italy

- Lafarge France

- Saint-Gobain France

- Wolseley UK

- Martin Marietta Materials US

- Vulcan Materials Company US

- List of Irish companies

References

- 1 2 3 "Preliminary Results 2015" (PDF). CRH plc. Retrieved 20 March 2016.

- ↑ "Our group". CRH plc. Retrieved 15 March 2015.

- ↑ CRH on Top1000.ie Irish Times 2013

- ↑ "CRH History Overview". crh.com. Retrieved 15 March 2015.

- ↑ "CRH plc". Irish Stock Exchange. Retrieved 20 March 2016.

- ↑ CRH buys French builders merchants Europolitics 7 October 1998

- ↑ "Scancem sells Finnsementti and Lohja Rudus operations to CRH". News Powered by Cision. Retrieved 15 March 2015.

- ↑ CRH bolts on Swiss firm in £335m deal Irish Independent 10 November 2000

- ↑ Dublin's CRH buys Mashav stake The Daily Deal | 9 August 2001

- ↑ CVC sells Cementbouw to CRH for €976m Dow Jones eFinancial News 30 July 2003

- ↑ CRH gets windfall of €574m as Portuguese firm buys out stake Irish Independent 26 April 2012

- ↑ Brown, Graeme (3 February 2015). "Lafarge Tarmac sold to Irish rival CRH in £5bn deal". Birmingham Post. Retrieved 17 February 2015.

- ↑ Callanan Industries purchased by Oldcastle, Inc. Callanan.com

- ↑ Irish building materials giant buys Bethesda masonry firm Washington Business Journal | 19 February 1990

- ↑ CRH buys four US businesses for $66m FT - UK Company News 5 August 1994

- ↑ Allied Products bought by CRH New York Times 5 July 1996

- ↑ CRH Acquires Major Materials Business in Ohio PR Newsire 24 February 2000

- ↑ "CRH's Oldcastle Group buys New Jersey quarry firm". RTÉ.ie. 30 April 2001. Retrieved 15 March 2015.

- ↑ CRH to Acquire APAC in Group's Largest Ever Transaction CeramicNews August 2006

- ↑ CRH spends €11.2m on US Concrete deal Irish Independent, 21 November 2007

- ↑ CRH buys US-based Pavestone for €348m RTÉ Business, 13 March 2008

- ↑ CRH raises holding in Polish firm to 86.9pc Irish Independent 30 October 1998

- ↑ International Cement Review. "CRH invests €210m in its Ukraine cement plant". cemnet.com. Retrieved 15 March 2015.

- ↑ CRH buys Ukrainian cement firm for €96m from rival Irish Independent 27 April 2013

- ↑ CRH buys 26% of Jilin Yatai China Daily, 9 January 2009

- ↑ CRH builds up China cement presence RTÉ Business, 17 October 2006

- ↑ CRH agrees to buy 50 pct stake in India's My Home Industries for €290 million Trading Markets, 20 March 2008

- ↑ CRH confirms continued interest in India GlobalCement, 4 January 2013

- ↑ "Board of Directors". crh.com. Retrieved 15 March 2015.

- ↑ CRH: People Reuters

- ↑ "What we do". CRH plc. Retrieved 20 March 2016.

- ↑ "CRH Historical Financial Data". crh.com. Retrieved 15 March 2015.

- ↑ CRH subsidiary fined €530,000 by Polish authority Cemnbet.com 14 May 2007

- ↑ Polish regulator fines CRH €26m Irish Examiner 11 December 2009

- ↑ €25m Polish fine a serious concern to CRH Irish Times via Aggregates Research 7 May 2010

- ↑ European Commission Press Release 30 November 1994

- ↑ Concrete Questions Irish Examiner 10 April 2012

- ↑ "Competition law action dismissed for delay". Stare Decisis Hibernia. Retrieved 15 March 2015.

- ↑ Judge pulls out of CRH case over shares Irish Times 14 November 2012

- ↑ Cartel claims rock the cement industry 10 May 2011

- ↑ "Irish Concrete Cartel Reported on RTE". YouTube. 15 June 2012. Retrieved 15 March 2015.

- ↑ Appellate Court Concurs On Antitrust Case Ruling 10 May 2010

- ↑ "Cement Price Fixing Investigation Lawsuits". yourlawyer.com. Retrieved 15 March 2015.

- ↑ Florida Antitrust parties settle prior to appellate court action 7 March 2012

- ↑ $1m bribe paid for CRH, Polish inquiry told Irish Times, 27 June 2005

- ↑ $1m bribe paid for CRH, Polish inquiry told Irish Times, 27 June 2005

- ↑ Poland's first lady says CRH gave cash to charity Irish Independent, 28 June 2005

- ↑ No hard questions asked of Charlie Haughey, then or now 14 December 2006

- ↑ Concrete Questions Irish Examiner, 10 April 2012

- ↑ Bank moves to block Harney's Ansbacher inquiry Irish Independent 14 January 1998

- ↑ Tribunal hears how Ansbacher accounts were run RTÉ, 22 February 2000

- ↑ Mr. Justice Moriarty issues statement on CRH shares 30 June 1999

- ↑ Dail debates Thursday, 30 September 1999

- ↑ High Court inspectors appointed to investigate Ansbacher RTÉ News, 22 September 1999

- 1 2 Report of the Inspectors Appointed to Enquire into the Affairs of Ansbacher (Cayman)Limited The High Court, 6 June 2002

- ↑ CRH orders probe over Ansbacher Irish Independent, 2 October 1999

- ↑ Statement by CRH plc 7 July 2002

- ↑ Glen Ding ghost haunts CRH Irish Independent, 30 April 2006

- ↑ Corruption was ‘a Fianna Fáil problem’ 28 March 2012

- ↑ Sale of State Lands at Glen Ding, Co. Wicklow Comptroller and Auditor General Special Report, 17 December 1998

- ↑ Moriarty Tribunal, Part One, Chapter 18 p 425-450 Archived 19 May 2011 at the Wayback Machine.

- ↑ Dail debates 15 November 2005

- ↑ Dail debates 11 September 2011